Understanding Mutual Funds: A Comprehensive Guide to Investing Wisely

UncategorizedIntroduction

In the ever-changing world of finance, investors have an abundance of ways to increase their wealth. One of the most well-liked and easily accessible investment vehicles is mutual funds, which give people the chance to diversify their portfolios and reach their financial objectives. We will delve into the world of mutual funds in this extensive tutorial, going over their forms, structure, advantages, dangers, and crucial factors to take into account as investors.

Mutual Funds

Mutual funds are well managed investment funds that combine the capital of several participants to buy and hold a variety of securities, including bonds, stocks, and combinations of the two. Professional fund managers or investment firms oversee mutual funds, making decisions about investments based on the goals and strategies of the fund. Generally designed as open-end funds, mutual funds enable investors to purchase and sell shares at the fund’s net asset value (NAV), which is determined by the market value of the underlying securities.

Features of Mutual Funds

Investment vehicles known as mutual funds combine the capital of multiple participants to purchase a diverse range of stocks, bonds, money market instruments, and other securities. The following are some crucial mutual fund features:

Diversification: To help spread risk, mutual funds make investments in a variety of securities. The impact of a single investment doing poorly can be lessened by this diversity.

Expert Fund Management: Skilled fund managers oversee mutual funds, making choices on investments on behalf of investors. To meet the goals of the fund, these managers monitor the portfolio and carry out research and analysis.

Liquidity: Mutual funds are known for their liquidity, as investors can usually purchase or sell shares at the fund’s net asset value (NAV), which is determined at the conclusion of each trading day, on any business day.

Transparency: Investors can access information about the securities held by mutual funds through periodic disclosures of their holdings, which are mandated by law.

Fees and Expenses: Mutual funds may levy management fees, administrative fees, and other operational costs. Depending on the fund and its investment strategy, these costs may change.

Automatic Reinvestment: Many mutual funds provide automatic dividend reinvestment programmes, in which dividends and capital gains distributions are reinvested to purchase further fund shares. This feature enables investors to compound their earnings over time while avoiding additional transaction fees.

Tax Efficiency: Some mutual funds use tax-efficient investment techniques to reduce tax liabilities for investors. Index funds, for example, typically have lower turnover ratios, which results in less capital gains distributions, potentially lowering investors’ taxable income.

Convenience: Investing in mutual funds allows investors to benefit from professional management and diversification without having to conduct significant research or actively participate in day-to-day investing choices. Investors can assign investment management tasks to competent specialists while focusing on other financial goals.

Types of Mutual Funds

Mutual funds are divided into different categories according to their risk profiles, asset classes, and investment goals. The following are a few typical mutual fund types:

Equity funds: The main asset class of these funds is stocks and other equity. They can be further divided into sectors (technology, healthcare, etc.), geographic focus (domestic, international, emerging markets), and market size (large-cap, mid-cap, small-cap).

Fixed-Income Funds: These are also referred to as bond funds, and they make investments in fixed-income instruments like corporate, municipal, and government bonds. They are often seen as less hazardous than equity funds and provide consistent income through interest payments.

Money Market Funds: These funds make investments in high-quality, short-term, liquid securities like commercial paper, Treasury bills, and certificates of deposit (CDs). They promise moderate returns in exchange for consistency and capital preservation.

Balanced Funds: These are also referred to as hybrid funds and involve investments in equities, bonds, and other instruments. Depending on the investment strategy and risk tolerance of the fund, the allocation between asset classes may change.

Index Funds: The goal of these funds is to mimic the performance of a certain market index, like the Dow Jones Industrial Average or the S&P 500. Because they don’t require as much stock selection or research as actively managed funds, they usually have lower expense ratios.

Sector Funds: These funds concentrate on particular markets or business sectors, such real estate, energy, healthcare, or technology. They provide investors with access to specific economic sectors.

Foreign/Global Funds: These funds make investments in securities that are held outside of the nation of residence of the investor. They may have a more expansive worldwide mission or concentrate on particular areas (like Europe or Asia).

Specialty Funds: These funds invest in niche markets or specialized strategies such as socially responsible investing (SRI), environmental, social, and governance (ESG) criteria, or commodities.

Target-Date Funds: These funds are designed to align with an investor’s retirement date. The asset allocation becomes more conservative as the target date approaches, reducing the risk exposure.

Alternative Funds: To accomplish their goals, these funds make use of alternative investing strategies such derivatives, real estate, commodities, and hedge fund tactics. Compared to regular mutual funds, they could be less regulated and have a larger risk.

Benefits of Mutual Funds

Diversification: Mutual funds invest in a diverse range of securities, including stocks, bonds, and other assets, by pooling the money of multiple investors. By distributing risk among several investments, diversification lessens the effect of a single investment’s underperformance.

Expert Fund Management: Professional fund managers oversee mutual funds, doing due diligence and deciding on investments on behalf of investors. Better investment results may result from these managers’ proficiency in asset allocation, securities selection, and market monitoring.

Accessibility: A broad spectrum of investors, including lone investors with modest capital, can take advantage of mutual funds. Investors who would not otherwise be able to engage in a variety of asset classes and investing strategies can do so with comparatively modest minimum investment requirements.

Liquidity: Mutual funds offer investors the ability to purchase or sell shares at the fund’s current net asset value (NAV) on any given business day. This is known as liquidity. Because of this liquidity feature’s flexibility, investors can access their money whenever they need to without incurring large transaction fees or waiting long periods.

Cost-Effectiveness: By taking advantage of economies of scale, mutual funds can cut costs. Mutual funds can possibly lower overall investment costs for investors by spreading costs like management fees, administrative charges, and trading expenses across a wider asset base by pooling assets from various participants.

Transparency: Information about the holdings, performance, and fees of mutual funds is transparent. To facilitate well-informed decision-making, investors have access to periodic reports, prospectuses, and disclosures that provide specifics about the fund’s investment strategy, portfolio composition, past performance, and related costs.

Convenience: Investing in mutual funds offers convenience, as investors can delegate investment decisions and portfolio management to professional fund managers. This hands-off approach saves time and effort for investors who may lack the expertise, time, or inclination to manage their investments actively.

Risk management: To reduce the risks associated with investments, mutual funds use a variety of risk management strategies. Fund managers control volatility and downside risk by diversifying their portfolios, carrying out in-depth research, and using risk assessment models. Their goal is to preserve investors’ cash while pursuing possible rewards.

Tax Efficiency: Through features like capital gains deferment and tax-loss harvesting, mutual funds can provide tax efficiency. Mutual funds aim to reduce investors’ tax liabilities by investing in tax-efficient assets and efficiently managing distributions, hence improving after-tax returns.

Investment alternatives: A variety of investment alternatives are provided by mutual funds to accommodate a range of investor preferences, risk tolerances, and financial objectives. Investment themes, income, growth, and capital preservation are just a few of the options available to investors when selecting mutual fund categories, strategies, and asset allocations that suit their goals.

How to Invest in Mutual Funds?

Individuals can engage in the financial markets in a convenient and diversified manner by investing in mutual funds. Mutual funds offer accessible investing options with different risk and return potentials, whether you’re saving for a big purchase, retirement, or just want to increase your wealth. This is a thorough guide explaining how to invest in mutual funds:

Know the Fundamentals: A mutual fund is a type of pooled investment instrument that allows participants to pool their money and use it to purchase a variety of stocks, bonds, and other securities. In proportion to the amount they invest, each investor has shares in the fund and shares in its profits and losses.

Establish Your Investment Goals: To begin, be sure that your time horizon, risk tolerance, and investment objectives are all clear. Are you saving money for a big purchase, retirement, or schooling? How long do you want to invest for, and how much risk are you willing to take? Knowing your objectives can help you choose the right mutual fund or funds for your portfolio.

Examine Various Mutual Fund Types: There are several different kinds of mutual funds, and each has a unique asset allocation, risk profile, and investing goals. Index funds (following market indexes), money market funds (short-term debt), balanced funds (stocks and bonds), bond funds (bonds), and specialty funds (such as sector-specific or foreign funds) are examples of common types. It will be easier for you to select funds if you are aware of and understand these categories and how they relate to your risk tolerance and goals.

Evaluate Fund Performance and Risk: After you’ve located possible mutual funds, evaluate the risk and performance of each one by looking at its expense ratios, risk measures, and past performance. Seek for steady long-term returns in comparison to peers and benchmark indices. Take into account volatility measurements, risk-adjusted returns, and the fund’s performance in various market scenarios. Examine the fund’s fees and expenses as well because excessive charges have the potential to gradually reduce profits.

Choose a Reputable Fund Provider: When making an investment, pick a trustworthy fund provider or financial organisation. Seek out reputable fund organisations that have a history of successfully managing mutual funds. Think about things like the experience of the fund manager, the availability of investment options that suit your goals, online tools and resources, and customer service.

Establish the Quantity and Frequency of Investment: Choose the amount and frequency of your mutual fund investments. A one-time payment can be made in full now, or you can schedule regular installments to make payments over time. By investing a certain amount on a regular basis, you can reduce market volatility and eventually your average cost per share by using dollar-cost averaging.

Place Your Investment Order: You can order shares of mutual funds as soon as your investment account has been financed. Indicate which fund or funds you wish to invest in, how much you want to invest, and any other instructions you may have (such as a preferred share class or investment plan). Remember that at the end of the trading day, mutual fund transactions are normally conducted at the fund’s net asset value (NAV).

Keep an eye on and assess your investments: Keep an eye on the success of your mutual fund investments on a regular basis and assess the asset allocation in your portfolio. Determine whether your investments match your risk tolerance and your goals, and adjust as needed. Periodically rebalance your portfolio to preserve diversification, and modify your investing plan in response to shifting market conditions or personal circumstances.

Seek Professional Guidance if Needed: If you’re unsure about which mutual funds to invest in or need assistance with portfolio management, consider seeking advice from a qualified financial advisor. An advisor can provide personalized recommendations based on your financial situation, goals, and risk tolerance, helping you make informed investment decisions and navigate the complexities of the financial markets.

In summary, mutual fund investment provides a simple and approachable means for people to accumulate wealth, meet their financial objectives, and take advantage of the markets’ potential growth. You can build a diverse portfolio that suits your needs and tastes by researching mutual funds thoroughly, choosing appropriate funds, keeping an eye on your investments, and knowing the fundamentals of mutual fund investing. To maximise your investing experience, never forget to be knowledgeable, maintain discipline, and seek professional advice when necessary.

Related Posts

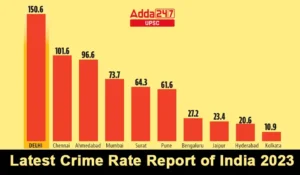

Latest and emerging forms of crime in India

Latest and emerging forms of crime in India India, with its vast and diverse landscape, is experiencing a paradigm shift in the nature and dynamics of criminal activities. The latest and emerging forms of crime in the country reflect the

Safeguarding Health: Advances and Challenges in Pharmacovigilance

Ms. Twinkle, Assistant Professor, GIP Geeta University Panipat Pharmacovigilance is the science and activities related to the detection, assessment, understanding, and prevention of adverse effects or any other drug-related problems. Its primary goal is to enhance patient safety and ensure